I?ve heard such great things about the Chase Sapphire Preferred card over the last few months ? especially the signup bonus!? Plenty of bloggers who track this sort of thing have highly recommended it.

?

The signup bonus for the Chase Freedom card definitely influenced us to get it, but we also knew that we would continue using it for its highlighted rewards categories and it has actually become our primary card.? The difference now is that we are happy with our current credit card rewards structure, so we would be getting the Sapphire card primarily for the signup bonus and would plan to cancel the card without ever paying the annual fee.? Kyle and I had a bit of an argument about whether or not this is ethical but it seems he?s okay with it overall.

?

I?ve been concerned recently about how we?re going to pay for what we need to out of our Travel and Personal Gifts account through Christmas, so using the signup bonus would help out amazingly!? The bonus is 40,000 points, which can be redeemed through the rewards site for up to $625 in airfare, so that would cover nearly the entire expense of our Christmas flights.? Plus we?re going to Canada in September so the double points on travel and not having foreign transaction fees would be lovely.

?

I was so excited about the prospect of this signup bonus that all day after we talked about it I was bugging Kyle showing him the above articles and saying how great it would be to get a relief from spending so much money on flights.

?

The only question left was whether or not we would be able to get the signup bonus, since that is the whole reason we would apply for the card.? To qualify for the bonus, we need to charge $3,000 in the first three months.? We can switch our recurring expenses over for that period and use it for every one-off charge except for gas (we get 5% back on gas in the third quarter so we?re going to keep using our Chase Freedom card for those expenses).

?

I looked back (using Mint!? love it!) at all the charges we?ve put on our credit cards in the last year, subtracted out the gas, and found that on average we charge $3.7k in a three-month period.? So far so good!

?

However, when I actually tried to project how much money we?d charge in the next three months, I really couldn?t come up with much.? I looked back over more recent months to figure out how much food we would charge, because since we?ve been going to ALDI we?ve been putting a lot less groceries on our credit cards.? We are expecting to spend quite a bit out of our targeted savings accounts in the next few months as the school year starts up, but our university only accepts checks.? The only savings account I can reasonably expect to spend out of on a credit card is our Appearance account (because that always seems empty) but we don?t put much money into that account.

?

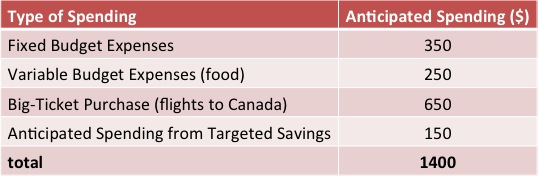

?

All of that only amounts to $1,400!? Of course some other random spending will come up, particularly out of our targeted savings accounts, but I can?t see how it would total more than a few hundred dollars.? It seems we are not going to spend anywhere near the $3,000 needed to get the bonus in the next 3 months.

?

The card is really attractive to us still and we?ll probably re-evaluate in a few months to see if we will spend enough to get the signup bonus, if it?s still available.? We pay our 6-month car insurance policy in November and of course will be buying flights and Christmas presents in Oct/Nov/Dec, so maybe the end of 2012/beginning of 2013 will be a better time.

?

Have you ever signed up for a credit card for the bonus and would you do it again?? If you keep a traditional monthly budget, do you ever go through the spending-projection exercise?? How much do you typically put on a credit card per month?

?

Source: http://evolvingpf.com/2012/07/not-the-chase-sapphire/

accuweather Finding Nemo 2 Provigil abc news denver post dez bryant Kitty Wells

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.